Domestic Security Loan: a loan supported by the worth of a home (a home)

GSE: acronym to possess bodies-paid enterprises: a set of economic features companies designed by the You Congress to attenuate rates of interest to possess producers and you will home owners. For example Federal national mortgage association and Freddie Mac computer.

Ginnie Mae: Authorities Federal Financial Relationship (GNMA); a national-possessed firm administered because of the You.S. Company from Construction and Urban Creativity, Ginnie Mae pools FHA-insured and you may Va-secured fund to help you back bonds having personal money; as with Fannie mae and you will Freddie Mac, the fresh funding income brings financial support that then use to help you qualified consumers from the lenders.

Revenues: currency acquired just before fees or other deductions. Sometimes it range from net income out-of worry about-a career, local rental assets, alimony, child service, social direction money, and you can retirement benefits.

Guaranty Fee: percentage so you’re able to FannieMae out of a lender towards the assurance off punctual dominant and you will focus money to help you MBS (Mortgage Recognized Coverage) protection owners.

H

HECM (Opposite Financial): the reverse home loan is used because of the elder property owners ages 62 and you will old to alter the fresh new guarantee in their house for the month-to-month channels of money and you can/or a personal line of credit to get repaid when they no prolonged undertake the home. A loan company such as a home loan company, lender, borrowing from the bank union or deals and you can financing relationship funds the brand new FHA covered loan, often called HECM.

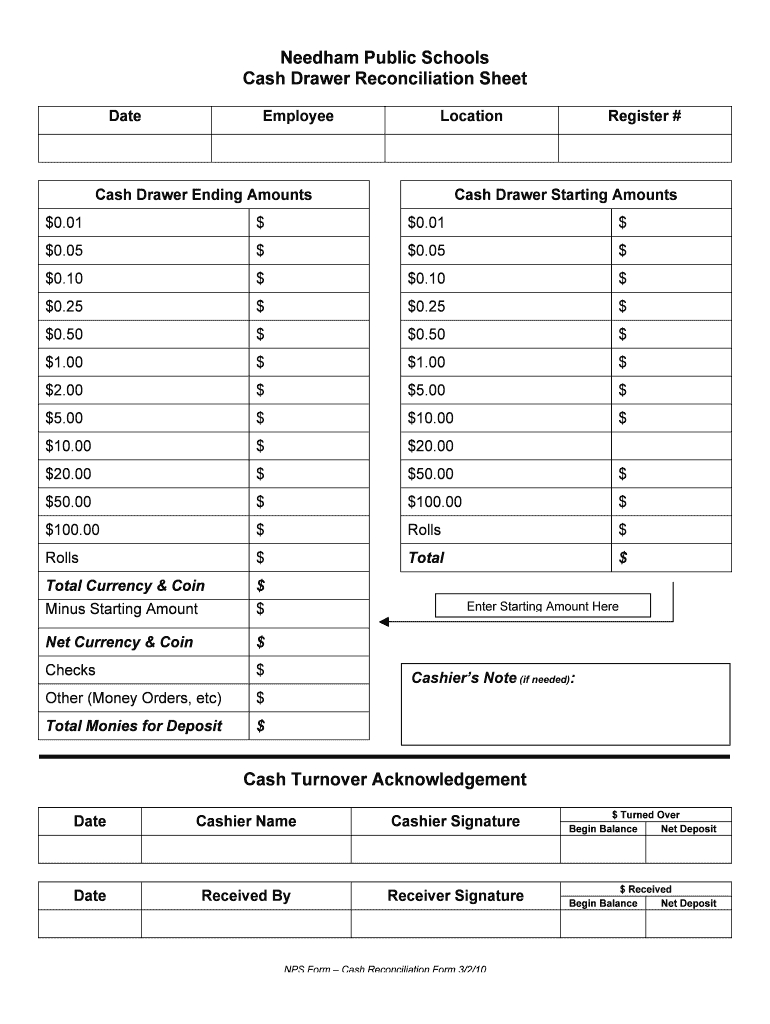

Products that show up on brand new report were a home income, financing charge, circumstances, and you will escrow wide variety

Hazard Insurance policies: coverage up against a particular losings, such as for instance flame, wind, etcetera., during a period of big date that’s protected of the percentage from an on a regular basis scheduled premium.

House Guarantee Personal line of credit: a mortgage loan, always from inside the next financial, allowing a debtor to obtain bucks against the security out-of an excellent domestic, doing a predetermined amount.

If for example the debtor non-payments otherwise doesn’t spend the money for mortgage, the lending company has some liberties into the property. New borrower can usually allege property security financing given that an excellent tax deduction.

House Review: a study of the structure and mechanized solutions to determine an effective house’s high quality, soundness, and you can shelter; helps to make the potential homebuyer aware of people fixes which may be necessary. The fresh homebuyer generally pays review costs.

Domestic Assurance: also provides shelter to own mechanical systems and you will affixed appliances facing unforeseen fixes not protected by homeowner’s insurance; visibility offers over a certain time and will not protection the fresh residence’s framework.

Homeowner’s Insurance policies: plans, referred to as possibility insurance policies, that mixes safeguards up against problems for a home and its own content material and fire, storms or other injuries with cover against states out-of negligence otherwise inappropriate action you to result in someone’s burns off otherwise assets destroy. Extremely lenders require homeowners insurance and may even escrow the price. Ton insurance is generally maybe not utilized in basic formula and ought to be obtained by themselves.

Homeownership Education Kinds: classes you to be concerned the need to build an effective credit score and provide information on how to acquire home financing approved, qualify for a loan, like a reasonable house, experience capital and you can closure techniques, and prevent mortgage problems that cause people to dump their homes.

Homestead Borrowing: possessions taxation borrowing system, offered by particular state governments, that provide decrease in the possessions fees so you’re able to qualified house.

Homes Guidance Agency: brings guidance and help somebody on different things, plus loan standard, reasonable casing, and you may home buying.

HUD: the newest U.S. Department away from Homes and Urban Invention; established in 1965, HUD operates to manage an excellent ericans; it can which of the handling property needs, boosting and development American communities, and you can enforcing fair property legislation.

HUD-step 1 Payment Declaration: known as the fresh settlement piece, or closing statement it itemizes all of the closing costs; have to be made available to this new debtor during the or before closing.