Must i Combine Financial obligation Before you buy property?

What if you have credit cards balance, car finance, and maybe your have pupil financial obligation. Simply put, your debt money. Let us and state, you decide your most useful strategy is so you’re able to consolidate your debt to own a lesser speed and solitary commission, very you are interested in that loan that enables you to definitely carry out therefore. Discover choices!

A classic debt consolidating financing most definitely will make handling their profit easier that can help you slow down the overall notice your pays, but can it effect your odds of getting a mortgage?

To determine any disadvantage, for those of you trying one another combine financial obligation and funds a home, take into account the adopting the issues.

https://paydayloanalabama.com/hollywood/

Whenever Must i get a debt negotiation Mortgage?

To choose even in the event a debt negotiation loan excellent to you there have been two key pieces you need to know; the phrase of obligations together with interest of one’s debt.

Label

Debt consolidation reduction loans might be best put when you have much time or open-ended identity debt with a high rates of interest as a result of the nature off how they try structured. Integration financing can get apparently short, specified words-usually anywhere between one seven age. This is why you might pay back stability earlier than you do having finance presenting offered conditions otherwise rotating style of obligations, including handmade cards.

Rates

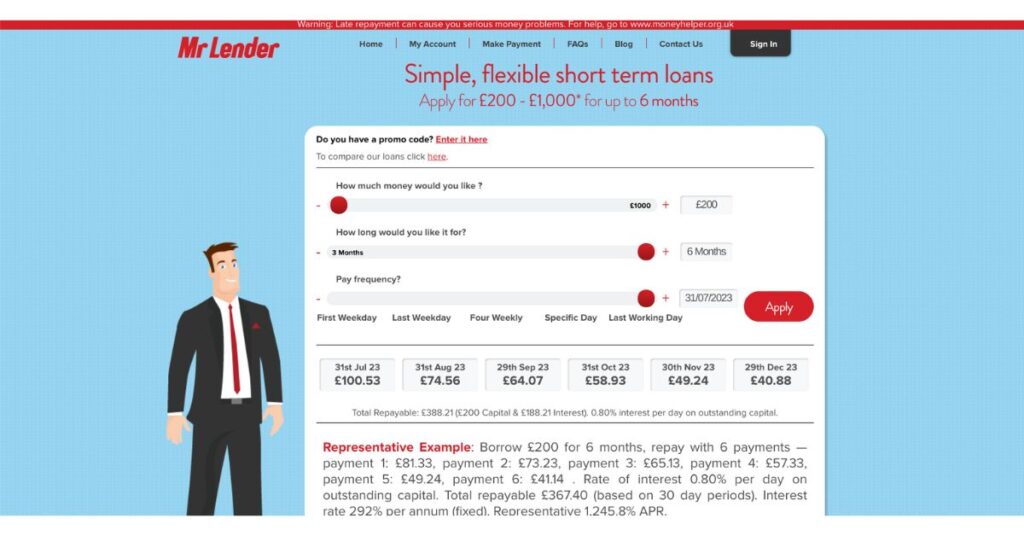

Consumers may also make use of all the way down interest levels when taking aside a debt negotiation loan. This is also true for personal credit card debt. Including, the average mastercard rate of interest was fourteen.7% in early 2021. Meanwhile, you will get taken out a debt consolidation mortgage with an enthusiastic average interest off nine.46%.

Within circumstance, the mixture of label and you will rates to the a combination loan perform enables you to pay-off your own personal credit card debt less and you may from the a lowered rate of interest, definition you would pay quicker out-of-pocket across the longevity of the loan. Just remember that the pace you’re getting would depend abreast of several points, including credit score along with your personal financial situation.

Commonly a debt settlement Financing Impact My Ability to Score good Financial?

Generally speaking, which have a debt settlement mortgage will not have a negative perception on your power to refinance your residence or obtain a separate financial. Actually, it may indeed improve your capability to meet the requirements.

Something that a loan provider usually assess from inside the financial or refinancing review can be your debt-to-earnings ratio. You can calculate this crucial formula by separating the total away from your own monthly expenses by the pre-income tax month-to-month income.

For example, if you make $4,000 thirty day period and you may pay $step 1,100 in the lease, $100 into credit card debt and something $600 1 month toward an automobile commission, the debt-to-income proportion try forty-five%, a number of factors over the 35% so you’re able to 40% that all mortgage brokers like to see.

Merging the debt could possibly keeps a confident effect on their debt-to-earnings proportion through the elimination of the level of your payment. For example, for many who move your car loan and you can credit card stability on the a great consolidated mortgage at a diminished rate of interest, and your monthly obligations was shorter so you’re able to $450, you can lower your new proportion to help you a spot for which you do more easily be eligible for home loan investment.

Can it be smart to Combine Personal debt for the a home loan?

It is rather well-known for people so you can combine personal debt, in addition to playing cards, auto and you can college loans into their financial. While the rates of interest having mortgage loans shall be below other styles of loans, such as credit cards, you might reduce the complete desire you pay having home financing financing as you are fundamentally utilizing your domestic because the collateral.

Going all of your costs with the home financing following causes it to be it is possible to so you can mix debt personal debt on one monthly payment from the a lower life expectancy rate of interest, and therefore reducing your complete monthly away-of-wallet expenses. So it advances your cash flow and may even have the ability on how best to even more aggressively spend less.

But not, there’s a downside. As the normal identity to own an excellent consolidated mortgage can be zero more than eight decades, a home loan identity usually discusses a fifteen- so you can 30-year schedule. That means, you’ll be paying thereon financial obligation while you are paying the loan on the home.

Ask questions and you can Suggestions Before you could Operate

Since you must examine these circumstances, and, you should sit down and you will talk to a mortgage bank before making your upcoming circulate. Financing administrator tend to ask you questions about their small- and you can a lot of time-title financial goals along with your present situation then, provide you with possibilities in order to generate informed choices.

Understand that your financial better-in the future lies in the options you will be making now! It doesn’t matter your standing, you possibly can make developments. Choosing the advice from leading pros is a great step of progress toward highway.